Facebook at the Crossroads: 3 Billion Users and the Battle for the Future

What next for Facebook?

As of 2026, to ask “how many people use Facebook” is to miss the point. The platform, born in a Harvard dorm room, has transcended its origins as a mere social network. With 3.07 billion monthly active users (MAUs), it is a global utility, a digital-first nation with a population dwarfing any country on Earth. It has become the default communication layer, a public square, and a sprawling marketplace for nearly 60% of the world’s entire social media population.

But beneath this staggering number lies a more complex narrative. Facebook, the classic “blue app,” is navigating a profound transition, fighting a war on two fronts. In its legacy markets, like the United States and Europe, it faces a battle for relevance against new-media giants and a maturing user base. Simultaneously, its explosive growth has shifted to new continents, bringing in hundreds of millions of new users from markets like India, Brazil, and Indonesia, which present a completely different monetization challenge.

This is the story of Facebook in 2025: a platform of unmatched scale, powered by a new AI engine, that is grappling with its own identity. It is no longer just one app but the anchor of the “Meta Family” an ecosystem of 3.98 billion monthly active people (MAPs) across Facebook, Instagram, WhatsApp, and Messenger. This is the story of how it got here, who its users are, and where it’s placing its multi-billion dollar bets for the future.

Unpacking the “3 Billion”: The Scale of a Digital Nation

The headline figures are the foundation of Facebook’s empire. As of 2025, the platform’s core user statistics are a testament to its deeply embedded role in daily life:

- Monthly Active Users (MAUs): 3.07 billion

- Daily Active Users (DAUs): 2.11 billion

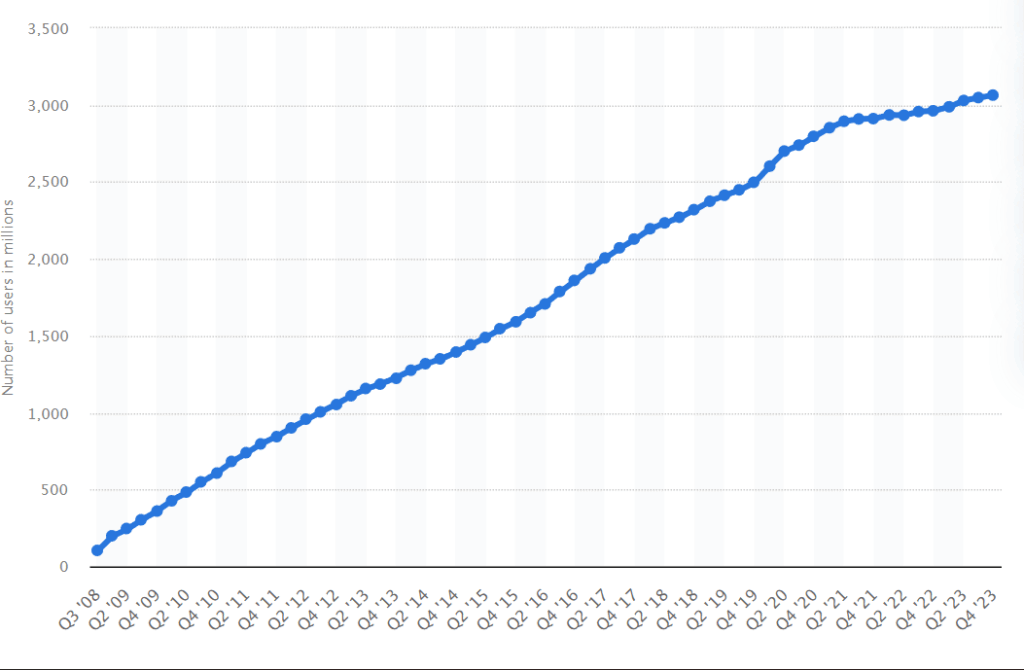

Facebook Quarterly users since 2008

The most critical number here is the DAU-to-MAU ratio: 68.7%. This “stickiness factor” is the envy of the tech world. It signifies that nearly seven out of every ten monthly users are not just passive members; they are active participants, logging in every single day. This is not just a platform; it’s a ritual, a daily habit as ingrained as a morning coffee.

This growth did not happen overnight, but its trajectory in the last decade alone shows a relentless expansion, even from a position of dominance.

Table 1: Facebook Monthly Active Users (MAUs) – The Last Decade

| Year | Monthly Active Users |

| 2015 | 1.59 billion |

| 2017 | 2.13 billion |

| 2019 | 2.50 billion |

| 2021 | 2.91 billion |

| 2023 | 3.03 billion (DataReportal) |

| 2025 | 3.07 billion |

Source: Social Media Curve

While the 3.07 billion figure for the “blue app” is massive, it strategically masks the true scale of Meta’s dominion. The company’s real moat is its “Family” of products.

Table 2: The Meta “Family” vs. The “Blue App” (2025)

| Metric | Facebook (Blue App) | Meta Family (FB, Insta, WhatsApp, Messenger) |

| Monthly Users | 3.07 billion (MAUs) | 3.98 billion (MAPs) |

| Daily Users | 2.11 billion (DAUs) | 3.35 billion (DAPs) |

With 3.98 billion unique monthly users, Meta’s services are accessed by nearly 70.5% of the world’s 5.65 billion active internet users. This ecosystem strategy is its defense: if a user’s attention wanes on Facebook, it is likely to be captured by Instagram or WhatsApp.

The New Geography of Facebook: A Tale of Two Planets

The era of US-centric growth is decisively over. Facebook’s user base is now overwhelmingly international, and its center of gravity has shifted dramatically toward the Asia-Pacific region.

India leads the world with a staggering 581.6 million Facebook users, more than double the user base of Facebook’s home country, the United States, which stands at 279.8 million.

Table 3: Top 10 Countries by Facebook User Base (2025)

| Rank | Country | Users (Millions) | % of Population |

| 1 | India | 581.6 | 40.08% |

| 2 | United States | 279.8 | 81.0% |

| 3 | Brazil | 175.1 | 82.6% |

| 4 | Indonesia | 174.0 | 61.38% |

| 5 | Mexico | 111.4 | 85.13% |

| 6 | Philippines | 102.3 | 88.32% |

| 7 | Vietnam | 86.1 | 85.27% |

| 8 | Russia | 70.6 | 48.76% |

| 9 | Turkey | 70.3 | 80.37% |

| 10 | Bangladesh | 67.2 | 38.71% |

Source: World Population Review

This geographical split reveals the single greatest strategic challenge for Meta: The ARPU Chasm.

ARPU, or Average Revenue Per User, is the metric that defines the company’s financial health. And the disparity is stark. While Meta has successfully acquired users in high-growth regions, it has not yet figured out how to monetize them at anywhere near the rate of its legacy markets.

- USA & Canada: $68.44 per user

- Europe: $23.14 per user

- Asia-Pacific: $5.52 per user

- Rest of World: $4.50 per user

This isn’t just a gap; it’s a chasm. A single American user is worth more than 12 times a user in the Asia-Pacific region, where the platform’s user base is largest and growing fastest. This financial reality dictates Meta’s entire corporate strategy. It explains the multi-billion dollar investments in AI-driven ad targeting, the push into e-commerce via Marketplace, and the development of new payment infrastructures for markets like India and Brazil. The future of Meta’s revenue growth depends entirely on closing this gap.

The Evolving Facebook User: A Shifting Demographic

So, who is the “average” Facebook user in 2026? The answer is complex and varies dramatically by region.

The Gender Split

Globally, the platform skews slightly male, with 55.3% male users to 44.7% female. However, this global average hides extreme regional variations. The United States, for instance, has a female-majority user base (53.8%). Other markets show even greater disparities, such as Pakistan (76.5% female) and Russia (58.9% male), reflecting deep cultural and internet-access differences.

The Age Story

The “Facebook is for old people” trope is a persistent, if simplified, narrative. The data shows a platform whose largest user base is firmly in the prime millennial and Gen X demographics.

Globally, the 25 to 34-year-old age group is the largest cohort, making up 25% of all users. This is the generation that came of age with Facebook, and they have stuck with it.

Table 4: Global Facebook Users by Age Group (2025)

| Age Group | Share of Users |

| 18 to 24 years | 15.71% |

| 25 to 34 years | 24.97% |

| 35 to 44 years | 18.68% |

| 45 to 54 years | 16.31% |

| 55 to 64 years | 14.31% |

| Over 65 years | 10.02% |

Source: Stafford

The US data paints a similar picture, highlighting the platform’s strength in the 25-54 “core” demographic.

Table 5: Facebook Users in the US by Age Group (2025)

| Age Group | Share of Users |

| 18 to 24 years | 18.6% |

| 25 to 34 years | 24.2% |

| 35 to 44 years | 19.0% |

| 45 to 54 years | 14.2% |

| 55 to 64 years | 11.7% |

| 65 and over | 12.3% |

Source: Statista

The strategic challenge is visible in the 18-24 bracket. While still a significant 15.7-18.6% of the user base, it’s smaller than the cohort above it. This is the “TikTok problem” visualized in data. Facebook is fighting to hold onto its aging-up core while desperately using tools like Reels to attract and retain younger users, who often split their time with other platforms.

And they do split their time. The modern internet user is not loyal to one platform.

- 77.6% of Facebook users also use Instagram

- 73.4% of Facebook users also use YouTube

- 72.9% of Facebook users also use WhatsApp

- 52.1% of Facebook users also use TikTok

The high overlap with Instagram and WhatsApp is by design, Meta’s walled garden is working. The high overlap with YouTube and TikTok, however, highlights the fierce, ongoing battle for a finite resource: the user’s attention.

A Day in the Life: How Billions Actually Use Facebook

How does a platform with 3 billion users function? The patterns of use reveal a deep entrenchment in mobile, a paradoxical relationship with time, and a clear set of user motivations.

The Mobile-Only Kingdom

First and foremost, Facebook is a mobile platform. The desktop is dead.

- 98.5% of users access Facebook via any kind of mobile device.

- 81.8% of users access Facebook only via a mobile phone.

- 1.5% of users access Facebook only via a laptop or desktop.

This is not a “mobile-first” company; it is a “mobile-only” one. Every feature, every ad, and every line of code is designed for a 6-inch screen, often on a less-than-perfect data connection in a high-growth market. This explains the 553 million app downloads in 2023 alone and the relentless focus on app performance and data efficiency.

The Time-Spent Paradox

While users log in daily, the average time spent on the platform in the US has fallen to around 20-22 minutes per day. This figure, often cited as a sign of decline, is misleading.

First, this was a strategic move by Meta, which famously changed its algorithm to prioritize “Meaningful Social Interactions” (friends, family, Groups) over viral media, knowing it would likely decrease session time but improve long-term user satisfaction.

Second, the 22-minute average hides a massive demographic skew.

Table 6: Average Time Spent on Facebook per Day (US) by Age

| Age Group | Average Time Spent |

| 18 to 24 years | 22 minutes |

| 25 to 34 years | 26 minutes |

| 35 to 44 years | 30 minutes |

| 45 to 54 years | 36 minutes |

| 55 to 64 years | 45 minutes |

| Over 65 years | 34 minutes |

Source: eMarketer

The data is clear: older users spend the most time on Facebook. The 55-64 age group spends more than double the time of the 18-24 cohort. This is the inverse of platforms like TikTok. Facebook has become the “lean-back” digital living room for its core, older audience, while younger users “snack” on content before moving on. This creates a content dilemma for creators and advertisers: who are you really trying to reach?

Why Do People Log In?

The platform’s primary function is no longer just “social media.” It is a multi-purpose utility.

Table 7: Top Reasons People Use Facebook

| Reason | % of Users |

| Message friends and family | 72.4% |

| Post or share photos or videos | 63.2% |

| Look for funny or entertaining content | 54.7% |

| Follow or research brands and products | 53.0% |

| Keep up to date with news and current events | 8.2% (Note: This has likely declined) |

Source: Data Reportal

The #1 reason is communication. Facebook is the world’s phonebook. This is why Meta has fought so hard to integrate Messenger and why WhatsApp is a key pillar of its “Family” strategy. The second and third reasons; posting content and finding entertainment, are the battleground where it competes with all other media. And for businesses, the fact that 53% of users are there to research products is the entire ballgame.

The AI Revolution and the Business of 3 Billion

Facebook’s present is massive, but its future is being built on artificial intelligence. This is the company’s single biggest bet.

The AI-Driven Feed

Facebook has fundamentally shifted from a “social graph” (what your friends post) to an “interest graph” (what our AI thinks you’ll like). This is a direct response to TikTok’s “For You” page.

As of 2025, more than 20% of the content in a person’s Facebook feed is recommended by AI from people, groups, or accounts they do not follow. This number is even higher on Instagram. The goal is no longer to just connect you; it’s to entertain you, even if your friends have become boring. This AI engine is powered by Meta’s Research SuperCluster (RSC), one of the world’s most powerful AI supercomputers, built with 16,000 GPUs.

This AI-first strategy extends to its 200 million+ businesses. Meta’s NLLB-200 (No Language Left Behind) AI model can translate 200 different languages, enabling a business in Ohio to sell to a customer in Vietnam seamlessly.

The Engagement Challenge

For marketers, understanding this new, AI-driven platform is critical. Organic reach is harder than ever, and the algorithm has clear preferences.

Table 8: Facebook Page Engagement Rates by Post Type

| Post Type | Average Fan Engagement Rate |

| Videos | 0.30% |

| Reels | 0.26% |

| Image/Photo | 0.24% |

| Albums | 0.22% |

| Status | 0.12% |

| Link Posts | 0.06% |

Source: Data Reportal

The data is an unambiguous directive: Facebook wants video. Link posts, which take users off-platform, are programmatically suppressed with a microscopic 0.06% engagement rate. Videos and Reels are heavily favored, as they keep users within Meta’s high-ad-load environment. For the 200 million businesses on the platform, the message is clear: adapt your content to video, or become invisible.

Conclusion: A Transformed and Transforming Giant

Facebook in 2026 is not one thing. It is a bundle of contradictions, a mature utility, and a bleeding-edge experiment.

- In the West, it is an aging, high-value utility—a communication and community tool that its core demographic cannot and will not leave.

- In the East and Global South, it is a high-growth, low-revenue social fabric, the primary “on-ramp” to the internet for hundreds of millions.

- For everyone, it is increasingly an AI-driven entertainment platform, locked in a brutal war for attention with YouTube and TikTok.

The platform’s 3.07 billion users are not a static audience; they are the population of a digital nation undergoing a seismic shift. The next decade of Facebook’s story will not be defined by user growth—it is running out of new humans to connect. Instead, it will be defined by transformation: the transformation of its low-revenue users into high-value customers and the transformation of its 20-year-old app into an AI-first content engine built to last.